The primary objective of the “Pradhan Mantri Mudra Yojana (PMMY)” initiated by the Indian government on April 8, 2015, is to stimulate innovation and advancement within the small and micro business sector to get mudra loan. Managed by Micro-Units Development & Refinance Agency Limited (Mudra), a subsidiary of the Small Industries Development Bank of India (SIDBI), the program facilitates financial support to small entrepreneurs. While Mudra supervises the nationwide implementation alongside the Department of Financial Services (DFS), the State Level Banker’s Committee (SLBC) oversees it at the state level. Notably, Mudra doesn’t directly provide loans but rather finances-approved Indian financial institutions, empowering them to offer Mudra loans to applicants. This initiative aims to rectify the historical disparity in institutional financial credit between small and large businesses in India, striving to empower small business proprietors and drive economic expansion.

Bridging Financial Gaps for Small Entrepreneurs

Financial entities such as banks in India and non-banking institutions, including Microfinance Institutions (MFIs) and Non-Banking Financial Companies (NBFCs), approved under Mudra, are authorized to extend loans as per Reserve Bank of India (RBI) directives. This initiative targets small businesses operating outside the corporate framework, focusing on non-agricultural endeavors, including agriculture-related activities like bee-keeping and horticulture. Eligible enterprises can access loans up to

10,00,000 rupees under the Mudra scheme. Application forms are available on Mudra’s website or from affiliated financial establishments.

Online applications are also accepted through the Mudra Loan Portal. Necessary documentation, encompassing business proposals, pertinent business and banking records, and personal identification papers, must accompany the application.

Intermediaries are not required for application submission. No collateral security is mandated for Mudra loan seekers. Depending on the application’s merits, applicants may qualify for one of three Mudra loan categories– Shishu, Kishor, or Tarun – each

offering distinct interest rates and repayment terms tailored to individual credit histories and repayment capabilities.

Mudra Scheme offers three distinct loan schemes tailored to businesses based on size and operational stage. Here are the details:

Shishu:

- For budding and recently launched small businesses.

- No upfront fees or processing charges for loan applications.

- Single-page application form.

- Eligible applicants can receive loans up to Rs. 50,000.

- Loan processing within two weeks.

- The repayment period of five years at an interest rate of 1% per month or 12% per year.

Kishor:

- For established businesses needing financial assistance for market

consolidation. - Loans ranging from Rs. 50,000 to Rs. 500,000.

- Three-page application form.

- Some banks may levy upfront or processing fees.

- Loan processing in four weeks.

- Repayment terms and interest rates are determined by the lending institution based on credit history and business cash flow.

Tarun:

- For expanding commercial operations of already established businesses.

- Loans from Rs. 500,000 to Rs. 10,00,000.

- Three-page application form.

- Possibility of upfront fees or processing charges.

- Loan disbursed within four weeks upon successful application.

- Repayment terms and interest rates tailored by the lending institution after evaluating the applicant’s credit history. Businesses, irrespective of their stage, must comply with filing financial statements and legal documentation for annual performance tracking. Annual compliance filing is mandatory for every business.

Apply Now

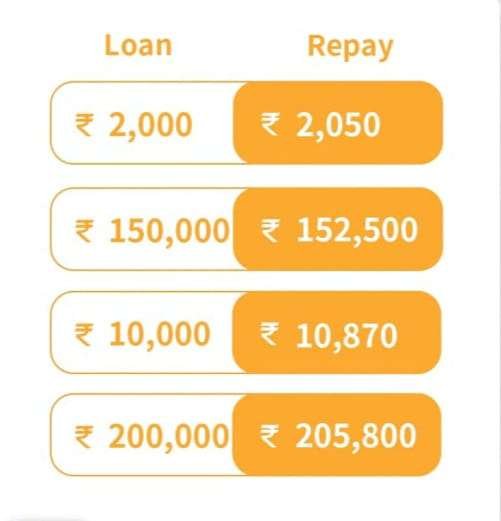

Interest Rates and Financial Institutions

Interest rates for Pradhan Mantri Mudra Yojna, except for the fixed 12% p.a. rate under the Shishu scheme, vary based on the discretion of lending institutions, which determine rates considering factors like credit risk, financial status, and past business

performance of loan applicants. These institutions follow RBI guidelines, with rates influenced by RBI’s Base Rate and Marginal Cost of Fund-Based Lending Rate (MCLR) fluctuations. Checking the current Base Rate and MCLR on the RBI website is advisable

for applicants. Commercial banks, both public and private, generally maintain similar interest rate caps, while cooperative, rural, and regional banks may vary up to 3.50%. Large microfinance institutions with substantial loan portfolios typically cap rates at

10%, while smaller ones may charge 12% or up to 2.75 times the average base rate of major commercial banks. NBFCs can exceed the Base Rate and MCLR by up to 6%, potentially charging interest rates of up to 15.45%.

Supporting Diverse Business Ventures

Financial institutions authorized by the DFS, including Indian banks such as scheduled commercial banks, state cooperative banks, regional rural banks, public sector banks, private sector banks, and foreign banks, can offer Mudra loans of up to 10,00,000

rupees. Other eligible institutions like co-operative societies, NBFCs, MFIs, Trust Companies, and Section 8 companies are empowered to extend Mudra loans.

For eligibility, institutions must exhibit a net worth of 100 crore rupees, maintain a consistent profit track record over three years, have gross NPAs of 3% or less, and possess a CRAR of at least 9%.

As for applicants, they must be Indian citizens of legal adult age with no history of loan defaults. A comprehensive business plan and requisite skills, qualifications, experience, and knowledge are essential. The loan limit is capped at 10,00,000 rupees for small and micro businesses involved in manufacturing, processing, trading, or services. Sole proprietorships, partnerships, private companies, and other non-corporate structures are eligible, including non-agricultural businesses associated with agriculture, excluding rice cultivation but inclusive of machinery manufacturing for rice production.

Businesses eligible for Mudra loan

● artisans

● beekeeping units

● car rental services

● carpentry workshops

● dairy units

● fashion boutiques

● floriculture units

● food vendors

● food processing units

● garment stores

● general stores

● horticulture units

● machine workshops

● paper goods manufacturing

● pottery workshops

● poultry units

● public transport carriers

● repair workshops

● reverse osmosis water treatment plants

● service sector units

● textile units

● vegetable vendors

Mudra loans can finance equipment and machinery acquisition, business premises establishment or renovation, and working capital infusion into operations. Applicants can assess their eligibility through the online Mudra loan eligibility test provided on the Mudra website.

The process for obtaining a Mudra loan is streamlined.

Initially, applicants should assess the terms and conditions of banks offering the PM Mudra Yojana scheme in their vicinity. Creating a comprehensive business plan is essential, providing crucial insights for banks to evaluate feasibility and scheme

eligibility. Following this, applicants should engage with bank representatives to determine suitable Mudra loan schemes.

Subsequently, downloading and completing the Mudra loan application form is necessary, with the submission of the required documentation to the chosen bank or financial institution. Online applications are also an option through the Mudra Loan

Portal. Following document review if everything is in order the bank will sanction the loan within two to four weeks, provided the business plan is approved.

Summary

The Pradhan Mantri Mudra Yojna strives to uplift India’s small and micro-business sector by providing financial support through three tailored loan schemes. With loan amounts up to 10,00,000 rupees, entrepreneurs can access funds for various business needs without collateral requirements. Managed by Mudra, this initiative aims to bridge the gap in financial credit between small and large businesses, fostering economic growth and empowerment. Eligible businesses from diverse sectors can benefit from Mudra loans, fueling innovation and expansion. The streamlined application process ensures accessibility, making Mudra a catalyst for small business success in India.

50000ka lon chahiy

50000

I need loan for my kids school fees

Ok

Good

urgent le loan chahie 5000

I need a loan for my children fee

1000000

you give me some money

I need money for project

I need to start business

I need money for house renewation

Hi I need a loan 20000

I need a business loan

Amar lon lagba bapsa kor ar lonno 20000

Dava,ke,liye

I went money important

Apply for loan

Hello

I think and want to start a dairy farm. So need loan for dairy farm

300000 laks lon chai ai

এই টাকাটা বিকাশ বানাবো দিলে দিয়েন

Rajinder Singh

Yes

How are you? I need a loan to build business. I Will really appreciate when you help me. 50,000

I need a fast loan for my treatment and business, I need help.

Ruth

50000 loan chahiye 12 months ke liye

Nini

Please help me

Please help me loene

First lone

Loan chaiye

Mujhe bhi loan chahie 500000 Tak

Yas

5000000

Ok

Hi

Lone apply

50000

500

Yes okay

Help me mujhe bahut jaruri hai loan ki mujhe ₹500000 Tak ke loan 6 sal ke liye chahie

Hlo sir loan ki help chahie

Yes

Please help me আমার 20000 টাকা লাগবে

Good

Hi

Please help me Mujhe 5 lakh ki avashyakta hai 6 sal ke liye

Very good

I need help for a loan 100,000 to build farming And business

Please lon

All I need a loan for 2000

Apne Ghar ke Liye loan apply kar raha hun

Please I interested loan for your company

Plz help me fruit business my experience 10year

I want money

Please help me I want k10000 for business

i want money

I want money, can I get this loan please

Do I qualify for the loan

Nurafsar 50000

Please help me some money i want to start businessplease

50000taka

Hi ,I need some ka loan

Wow

Save may

Wow

Loon

Mst

Loan plz

Home loan and 50pokets of cement

Help with a loan l want to put on my business

Fill this form

https://forms.gle/AX1EZ1f7YEYTTRZC6

Please ineed a loan to clear my school fees and started my firming

Hello sir

10000 mony loan pleas

Mudra lone

I really need this money. I will pay in time

I Need 2laks loan for personal loan

I want to take a loan of 20 thousand rupeesI want to take a loan of 20 thousand rupees

Dear sir madam

I’m looking personal loan for my son

He is study in Canada

Hello sir I am looking business loan

50000ka lon chahiy

15000

20000

I need help ples

Ples help

I need help

iam Bhima

2laks loan for personal loan

I have need loan amoumnt 15,00000 taka need for minimaum 5/6 years of period

I need lone for money

I need lone for money plz applying

Plz plz help me 10000 applying